THE STEEL POST brings you stories, live feeds, information and inspiration that will help you to make the most out of each and every day. Freddie and Mary Gaye Steel are the former founding/lead pastors of the vibrant, multicultural Mercy Gate International - A Charismatic Church in the Southwest Chicago Suburb of Palos Heights. Be sure to visit: www.MercyGateway.org and www.Twitter.com/ChurchRightNow . . . (CHECK OUT THE GREAT RESOURCES AVAILABLE ON OUR BLOG!)

PLEASE 'SHARE' OR 'LIKE' LIBERALLY AND HELP US TO 'GET THE WORD OUT!'

Showing posts with label deficit. Show all posts

Showing posts with label deficit. Show all posts

Friday, January 17, 2014

China Holds Record Amountof US Debt!

news, opinion, currencies, markets,

china,

debt,

debt clock,

deficit,

markets,

trade,

trade deficit,

transatlantic trade deal

Thursday, January 9, 2014

From the Guardian: This Transatlantic Trade Deal Is A Full-Frontal Assault On Democracy | George Monbiot

Freddie Steel thought you might be interested in this link from the Guardian: This transatlantic trade deal is a full-frontal assault on democracy | George Monbiot

Brussels has kept quiet about a treaty that would let rapacious companies subvert our laws, rights and national sovereignty

George Monbiot

Monday 4 November 2013

The Guardian

http://www.theguardian.com/commentisfree/2013/nov/04/us-trade-deal-full-frontal-assault-on-democracy

----

Remember that referendum about whether we should create a single market with the United States? You know, the one that asked whether corporations should have the power to strike down our laws? No, I don't either. Mind you, I spent 10 minutes looking for my watch the other day before I realised I was wearing it. Forgetting about the referendum is another sign of ageing. Because there must have been one, mustn't there? After all that agonising over whether or not we should stay in the European Union, the government wouldn't cede our sovereignty to some shadowy, undemocratic body without consulting us. Would it?

The purpose of the Transatlantic Trade and Investment Partnership is to remove the regulatory differences between the US and European nations. I mentioned it a couple of weeks ago. But I left out the most important issue: the remarkable ability it would grant big business to sue the living daylights out of governments which try to defend their citizens. It would allow a secretive panel of corporate lawyers to overrule the will of parliament and destroy our legal protections. Yet the defenders of our sovereignty say nothing.

The mechanism through which this is achieved is known as investor-state dispute settlement. It's already being used in many parts of the world to kill regulations protecting people and the living planet.

The Australian government, after massive debates in and out of parliament, decided that cigarettes should be sold in plain packets, marked only with shocking health warnings. The decision was validated by the Australian supreme court. But, using a trade agreement Australia struck with Hong Kong, the tobacco company Philip Morris has asked an offshore tribunal to award it a vast sum in compensation for the loss of what it calls its intellectual property.

During its financial crisis, and in response to public anger over rocketing charges, Argentina imposed a freeze on people's energy and water bills (does this sound familiar?). It was sued by the international utility companies whose vast bills had prompted the government to act. For this and other such crimes, it has been forced to pay out over a billion dollars in compensation. In El Salvador, local communities managed at great cost (three campaigners were murdered) to persuade the government to refuse permission for a vast gold mine which threatened to contaminate their water supplies. A victory for democracy? Not for long, perhaps. The Canadian company which sought to dig the mine is now suing El Salvador for $315m – for the loss of its anticipated future profits.

In Canada, the courts revoked two patents owned by the American drugs firm Eli Lilly, on the grounds that the company had not produced enough evidence that they had the beneficial effects it claimed. Eli Lilly is now suing the Canadian government for $500m, and demanding that Canada's patent laws are changed.

These companies (along with hundreds of others) are using the investor-state dispute rules embedded in trade treaties signed by the countries they are suing. The rules are enforced by panels which have none of the safeguards we expect in our own courts. The hearings are held in secret. The judges are corporate lawyers, many of whom work for companies of the kind whose cases they hear. Citizens and communities affected by their decisions have no legal standing. There is no right of appeal on the merits of the case. Yet they can overthrow the sovereignty of parliaments and the rulings of supreme courts.

You don't believe it? Here's what one of the judges on these tribunals says about his work. "When I wake up at night and think about arbitration, it never ceases to amaze me that sovereign states have agreed to investment arbitration at all ... Three private individuals are entrusted with the power to review, without any restriction or appeal procedure, all actions of the government, all decisions of the courts, and all laws and regulations emanating from parliament."

There are no corresponding rights for citizens. We can't use these tribunals to demand better protections from corporate greed. As the Democracy Centre says, this is "a privatised justice system for global corporations".

Even if these suits don't succeed, they can exert a powerful chilling effect on legislation. One Canadian government official, speaking about the rules introduced by the North American Free Trade Agreement, remarked: "I've seen the letters from the New York and DC law firms coming up to the Canadian government on virtually every new environmental regulation and proposition in the last five years. They involved dry-cleaning chemicals, pharmaceuticals, pesticides, patent law. Virtually all of the new initiatives were targeted and most of them never saw the light of day." Democracy, as a meaningful proposition, is impossible under these circumstances.

This is the system to which we will be subject if the transatlantic treaty goes ahead. The US and the European commission, both of which have been captured by the corporations they are supposed to regulate, are pressing for investor-state dispute resolution to be included in the agreement.

The commission justifies this policy by claiming that domestic courts don't offer corporations sufficient protection because they "might be biased or lack independence". Which courts is it talking about? Those of the US? Its own member states? It doesn't say. In fact it fails to produce a single concrete example demonstrating the need for a new, extrajudicial system. It is precisely because our courts are generally not biased or lacking independence that the corporations want to bypass them. The EC seeks to replace open, accountable, sovereign courts with a closed, corrupt system riddled with conflicts of interest and arbitrary powers.

Investor-state rules could be used to smash any attempt to save the NHS from corporate control, to re-regulate the banks, to curb the greed of the energy companies, to renationalise the railways, to leave fossil fuels in the ground. These rules shut down democratic alternatives. They outlaw leftwing politics.

This is why there has been no attempt by the UK government to inform us about this monstrous assault on democracy, let alone consult us. This is why the Conservatives who huff and puff about sovereignty are silent. Wake up, people we're being shafted.

Twitter: @georgemonbiot. A fully referenced version of this article can be found at monbiot.com

If you have any questions about this email, please contact the theguardian.com user help desk: userhelp@theguardian.com.

theguardian.com Copyright (c) Guardian News and Media Limited. 2014 Registered in England and Wales No. 908396 Registered office: PO Box 68164, Kings Place, 90 York Way, London N1P 2AP

Brussels has kept quiet about a treaty that would let rapacious companies subvert our laws, rights and national sovereignty

• Ken Clarke responds to this article

George Monbiot Monday 4 November 2013

The Guardian

http://www.theguardian.com/commentisfree/2013/nov/04/us-trade-deal-full-frontal-assault-on-democracy

----

Remember that referendum about whether we should create a single market with the United States? You know, the one that asked whether corporations should have the power to strike down our laws? No, I don't either. Mind you, I spent 10 minutes looking for my watch the other day before I realised I was wearing it. Forgetting about the referendum is another sign of ageing. Because there must have been one, mustn't there? After all that agonising over whether or not we should stay in the European Union, the government wouldn't cede our sovereignty to some shadowy, undemocratic body without consulting us. Would it?

The purpose of the Transatlantic Trade and Investment Partnership is to remove the regulatory differences between the US and European nations. I mentioned it a couple of weeks ago. But I left out the most important issue: the remarkable ability it would grant big business to sue the living daylights out of governments which try to defend their citizens. It would allow a secretive panel of corporate lawyers to overrule the will of parliament and destroy our legal protections. Yet the defenders of our sovereignty say nothing.

The mechanism through which this is achieved is known as investor-state dispute settlement. It's already being used in many parts of the world to kill regulations protecting people and the living planet.

The Australian government, after massive debates in and out of parliament, decided that cigarettes should be sold in plain packets, marked only with shocking health warnings. The decision was validated by the Australian supreme court. But, using a trade agreement Australia struck with Hong Kong, the tobacco company Philip Morris has asked an offshore tribunal to award it a vast sum in compensation for the loss of what it calls its intellectual property.

During its financial crisis, and in response to public anger over rocketing charges, Argentina imposed a freeze on people's energy and water bills (does this sound familiar?). It was sued by the international utility companies whose vast bills had prompted the government to act. For this and other such crimes, it has been forced to pay out over a billion dollars in compensation. In El Salvador, local communities managed at great cost (three campaigners were murdered) to persuade the government to refuse permission for a vast gold mine which threatened to contaminate their water supplies. A victory for democracy? Not for long, perhaps. The Canadian company which sought to dig the mine is now suing El Salvador for $315m – for the loss of its anticipated future profits.

In Canada, the courts revoked two patents owned by the American drugs firm Eli Lilly, on the grounds that the company had not produced enough evidence that they had the beneficial effects it claimed. Eli Lilly is now suing the Canadian government for $500m, and demanding that Canada's patent laws are changed.

These companies (along with hundreds of others) are using the investor-state dispute rules embedded in trade treaties signed by the countries they are suing. The rules are enforced by panels which have none of the safeguards we expect in our own courts. The hearings are held in secret. The judges are corporate lawyers, many of whom work for companies of the kind whose cases they hear. Citizens and communities affected by their decisions have no legal standing. There is no right of appeal on the merits of the case. Yet they can overthrow the sovereignty of parliaments and the rulings of supreme courts.

You don't believe it? Here's what one of the judges on these tribunals says about his work. "When I wake up at night and think about arbitration, it never ceases to amaze me that sovereign states have agreed to investment arbitration at all ... Three private individuals are entrusted with the power to review, without any restriction or appeal procedure, all actions of the government, all decisions of the courts, and all laws and regulations emanating from parliament."

There are no corresponding rights for citizens. We can't use these tribunals to demand better protections from corporate greed. As the Democracy Centre says, this is "a privatised justice system for global corporations".

Even if these suits don't succeed, they can exert a powerful chilling effect on legislation. One Canadian government official, speaking about the rules introduced by the North American Free Trade Agreement, remarked: "I've seen the letters from the New York and DC law firms coming up to the Canadian government on virtually every new environmental regulation and proposition in the last five years. They involved dry-cleaning chemicals, pharmaceuticals, pesticides, patent law. Virtually all of the new initiatives were targeted and most of them never saw the light of day." Democracy, as a meaningful proposition, is impossible under these circumstances.

This is the system to which we will be subject if the transatlantic treaty goes ahead. The US and the European commission, both of which have been captured by the corporations they are supposed to regulate, are pressing for investor-state dispute resolution to be included in the agreement.

The commission justifies this policy by claiming that domestic courts don't offer corporations sufficient protection because they "might be biased or lack independence". Which courts is it talking about? Those of the US? Its own member states? It doesn't say. In fact it fails to produce a single concrete example demonstrating the need for a new, extrajudicial system. It is precisely because our courts are generally not biased or lacking independence that the corporations want to bypass them. The EC seeks to replace open, accountable, sovereign courts with a closed, corrupt system riddled with conflicts of interest and arbitrary powers.

Investor-state rules could be used to smash any attempt to save the NHS from corporate control, to re-regulate the banks, to curb the greed of the energy companies, to renationalise the railways, to leave fossil fuels in the ground. These rules shut down democratic alternatives. They outlaw leftwing politics.

This is why there has been no attempt by the UK government to inform us about this monstrous assault on democracy, let alone consult us. This is why the Conservatives who huff and puff about sovereignty are silent. Wake up, people we're being shafted.

Twitter: @georgemonbiot. A fully referenced version of this article can be found at monbiot.com

If you have any questions about this email, please contact the theguardian.com user help desk: userhelp@theguardian.com.

theguardian.com Copyright (c) Guardian News and Media Limited. 2014 Registered in England and Wales No. 908396 Registered office: PO Box 68164, Kings Place, 90 York Way, London N1P 2AP

news, opinion, currencies, markets,

brics,

deficit,

dollar,

federal reserve,

shanghai cooperation organization,

transatlantic trade deal,

world trade organization

Wednesday, October 30, 2013

U.S. Debt Problems 'Casting Global Shadow': EU's Barroso - Yahoo News

U.S. debt problems 'casting global shadow': EU's Barroso - Yahoo News

It is not unreasonable to imagine that at some point the global community will become intolerant of our lack of fiscal and political responsibility and ban together to force us into a compliance that lessens our threat to the global economy does so at a high cost to our sovereignty. - FS

It is not unreasonable to imagine that at some point the global community will become intolerant of our lack of fiscal and political responsibility and ban together to force us into a compliance that lessens our threat to the global economy does so at a high cost to our sovereignty. - FS

news, opinion, currencies, markets,

barroso,

bilderberg,

cfr,

club of rome,

debt,

deficit,

dollar,

eu,

fed,

federal reserve,

imf,

solvency

Location: Chicago, IL, USA

Charlotte, NC, USA

Friday, October 25, 2013

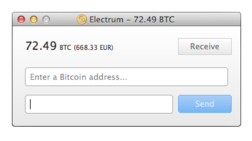

World's First Bitcoin ATM Set to Go Live Tuesday | Wired Enterprise | Wired.com

World's First Bitcoin ATM Set to Go Live Tuesday | Wired Enterprise | Wired.com

Bitcoins are cryptocurrency for conducting global trade through peer-to-peer merchants. - Freddie Steel

Bitcoin (sign:  ; code: BTC or XBT[8]) is a distributed peer-to-peer digital currency that functions without the intermediation of any central authority.[9] The concept was introduced in a 2008 paper by a pseudonymous developer known only as "Satoshi Nakamoto".[1]

; code: BTC or XBT[8]) is a distributed peer-to-peer digital currency that functions without the intermediation of any central authority.[9] The concept was introduced in a 2008 paper by a pseudonymous developer known only as "Satoshi Nakamoto".[1]

Bitcoin is called a cryptocurrency since it is decentralized and uses cryptography to prevent double-spending, a significant challenge inherent to digital currencies.[9] Once validated, every individual transaction is permanently recorded in a public ledger known as the blockchain.[9] The calculations required to authenticate Bitcoin transactions are completed using a network of private computers often specially tailored to this task.[10] As of May 2013, the Bitcoin network processing power "exceeds the combined processing strength of the top 500 most powerful supercomputers".[11] The operators of these computers, known as "miners", are rewarded with transaction fees and newly minted bitcoins. However, new bitcoins are created at an ever-decreasing rate.[9] Once 21 million bitcoins are distributed, issuance will cease.[9] As of August 2013, approximately 11.5 million bitcoins were in circulation.[12]

In 2012, The Economist reasoned that Bitcoin has been popular due to "its role in dodgy online markets,"[13] and in 2013 the FBI shut down one such service, Silk Road, which allowed the sale of illegal drugs for bitcoins. However, bitcoins are increasingly used as payment for legitimate products and services.[14] Notable vendors include Wordpress, OkCupid, Reddit, and Chinese Internet giant Baidu.[15]

Speculators have been attracted to Bitcoin, fueling volatility and price swings. In July 2013, Cameron and Tyler Winklevoss asserted that "there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators."[16]

The Bitcoin network protocol operates to provide solutions to the problems associated with creating a decentralized currency and a peer-to-peer payment network. Key among them is the use of a blockchain to achieve consensus and to solve the double-spending problem.

A bitcoin is defined by a chain of digitally-signed transactions that began with its creation as a block reward through bitcoin mining. Each owner transfers bitcoins to the next by digitally signing them over to the next owner in a Bitcoin transaction. A payee can then verify each previous transaction to verify the chain of ownership.

Bitcoin exchanges regularly fail, and the vast majority of transactions are completed on a single exchange that was originally a site for trading Magic: The Gathering cards online, Mt. Gox.

According to Reuters, undisclosed documents indicate that banks such as Morgan Stanley and Goldman Sachs have visited Bitcoin exchanges as often as 30 times a day. Employees of international banks and major financial organizations have shown interest in Bitcoin markets as well.[100]

Bitcoins have been described as lacking intrinsic value as an investment because their value depends only on the willingness of users to accept it.[106][107][108] In addition, a study indicated that 45 percent of Bitcoin exchanges end up closing with many customers losing their money.[109]

Like many assets, bitcoins are also subject to theft.

Derivatives on bitcoins are thinly available. One organization offers futures contracts on bitcoins against multiple currencies.[110]

Several bitcoin investors have become entrepreneurs in the evolving bitcoin universe. Efforts are underway to build financial services, new exchanges, and new payment products using bitcoin. Interest in the bitcoin sector has arisen from investment funds, with recent Peter Thiel's Founders Fund investing US$3 million in the sector and the Winklevoss twins making a US$1.5 million investment.[111]

Bitcoins are cryptocurrency for conducting global trade through peer-to-peer merchants. - Freddie Steel

Bitcoin

From Wikipedia, the free encyclopedia

| Bitcoin | |

|---|---|

A digital Bitcoin wallet

|

|

| Ledger | The majority of the Bitcoin peer-to-peer network regulates transactions and balances.[1][2] |

| Date of introduction | 3 January 2009 |

| Source | Bitcoin Genesis Block |

| User(s) | International |

| Issuance | Limited release |

| Source | Total BTC in Circulation |

| Method | The rate of new bitcoin creation will be halved every four years until there are 21 million BTC[3] |

| Subunit | |

| .001 | mBTC (millicoin) |

| .000001 | μBTC (microcoin) |

| .00000001 | satoshi[4] |

| Symbol | BTC, XBT,[5] |

Bitcoin is called a cryptocurrency since it is decentralized and uses cryptography to prevent double-spending, a significant challenge inherent to digital currencies.[9] Once validated, every individual transaction is permanently recorded in a public ledger known as the blockchain.[9] The calculations required to authenticate Bitcoin transactions are completed using a network of private computers often specially tailored to this task.[10] As of May 2013, the Bitcoin network processing power "exceeds the combined processing strength of the top 500 most powerful supercomputers".[11] The operators of these computers, known as "miners", are rewarded with transaction fees and newly minted bitcoins. However, new bitcoins are created at an ever-decreasing rate.[9] Once 21 million bitcoins are distributed, issuance will cease.[9] As of August 2013, approximately 11.5 million bitcoins were in circulation.[12]

In 2012, The Economist reasoned that Bitcoin has been popular due to "its role in dodgy online markets,"[13] and in 2013 the FBI shut down one such service, Silk Road, which allowed the sale of illegal drugs for bitcoins. However, bitcoins are increasingly used as payment for legitimate products and services.[14] Notable vendors include Wordpress, OkCupid, Reddit, and Chinese Internet giant Baidu.[15]

Speculators have been attracted to Bitcoin, fueling volatility and price swings. In July 2013, Cameron and Tyler Winklevoss asserted that "there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators."[16]

1.2 Payment network and mining

The Bitcoin network protocol operates to provide solutions to the problems associated with creating a decentralized currency and a peer-to-peer payment network. Key among them is the use of a blockchain to achieve consensus and to solve the double-spending problem.

A bitcoin is defined by a chain of digitally-signed transactions that began with its creation as a block reward through bitcoin mining. Each owner transfers bitcoins to the next by digitally signing them over to the next owner in a Bitcoin transaction. A payee can then verify each previous transaction to verify the chain of ownership.

3 Economics

Large fluctuations in the value of Bitcoin have led to criticism of its usefulness as a currency.[93] In addition, its deflationary bias encourages hoarding.[94] This reduces the the use value of a currency and has been the downfall of other private currencies.[95] However, currently Bitcoin does see some use as a currency[96] as well as being saved by individuals.[97]3.1 Exchanges

Through various exchanges, bitcoins are bought and sold at a variable price against the value of other currency. Bitcoin has appreciated rapidly in relation to other currencies including the US dollar, euro and British pound.[84][98][99]Bitcoin exchanges regularly fail, and the vast majority of transactions are completed on a single exchange that was originally a site for trading Magic: The Gathering cards online, Mt. Gox.

According to Reuters, undisclosed documents indicate that banks such as Morgan Stanley and Goldman Sachs have visited Bitcoin exchanges as often as 30 times a day. Employees of international banks and major financial organizations have shown interest in Bitcoin markets as well.[100]

3.2 Bitcoin as an investment

Although the Bitcoin Project describes bitcoin exclusively as an "experimental digital currency," [101] bitcoins are often traded as an investment.[102] Critics have accused bitcoin of being a form of investment fraud known as a Ponzi scheme.[103][104] A case study report[105] by the European Central Bank observes that the bitcoin currency system shares some characteristics with Ponzi schemes, but also has characteristics which are distinct from the common aspects of Ponzi schemes as defined by the U.S. Securities and Exchange Commission.Bitcoins have been described as lacking intrinsic value as an investment because their value depends only on the willingness of users to accept it.[106][107][108] In addition, a study indicated that 45 percent of Bitcoin exchanges end up closing with many customers losing their money.[109]

Like many assets, bitcoins are also subject to theft.

Derivatives on bitcoins are thinly available. One organization offers futures contracts on bitcoins against multiple currencies.[110]

Several bitcoin investors have become entrepreneurs in the evolving bitcoin universe. Efforts are underway to build financial services, new exchanges, and new payment products using bitcoin. Interest in the bitcoin sector has arisen from investment funds, with recent Peter Thiel's Founders Fund investing US$3 million in the sector and the Winklevoss twins making a US$1.5 million investment.[111]

Retrieved from "http://en.wikipedia.org/w/index.php?title=Bitcoin&oldid=578887697"

- This page was last modified on October 26, 2013 at 18:38.

- Text is available under the Creative Commons Attribution-ShareAlike License;

additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy.

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

news, opinion, currencies, markets,

bitcoins,

commerce,

cryptocurrency,

currency,

deficit,

dollar,

efts,

gdp,

trading

Location: Chicago, IL, USA

Chicago, IL, USA

Virtues Of Cryptocurrency

http://www.pbs.org/newshour/rundown/2013/10/a-bitcoin-evangelist-on-the-virtues-of-cryptocurrency.html

news, opinion, currencies, markets,

banking,

commerce,

cryptocurrency,

deficit,

dollar,

eft,

efts,

markets

Location: Chicago, IL, USA

Chicago, IL, USA

Feds Alarm Over Shadow Banking

http://goldnews.bullionvault.com/shadow-banking-100720136

Shadow banking system

Shadow banking system

From Wikipedia, the free encyclopedia

The shadow banking system is a pejorative term for the collection of non-bank financial intermediaries that provide services similar to traditional commercial banks. It is sometimes said to include entities such as hedge funds, money market funds, structured investment vehicles (SIV), "credit investment funds, exchange-traded funds, credit hedge funds, private equity funds, securities broker dealers, credit insurance providers, securitization and finance companies."(Jones 2013)[1]

but the meaning and scope of shadow banking is disputed in academic

literature. According to Hervé Hannoun, Deputy General Manager of the Bank for International Settlements

(BIS), investment banks as well as commercial banks may conduct much of

their business in the shadow banking system (SBS), but most are not

generally classed as SBS institutions themselves.(Hannoun 2008)[2][3] At least one financial regulatory expert has said that regulated banking organizations are the largest shadow banks.[4]

The core activities of investment banks are subject to regulation and monitoring by central banks and other government institutions - but it has been common practice for investment banks to conduct many of their transactions in ways that don't show up on their conventional balance sheet accounting and so are not visible to regulators or unsophisticated investors.[5] For example, prior to the 2007-2012 financial crisis, investment banks financed mortgages through off-balance sheet (OBS), or Incognito Leverage, securitizations (e.g. asset-backed commercial paper programs) and hedged risk through off-balance sheet credit default swaps.[5] No major investment banks exist in the United States other than those that are part of the regulated banking system. (In 2008, Morgan Stanley and Goldman Sachs became bank holding companies, Merrill Lynch and Bear Stearns were acquired by bank holding companies, and Lehman Brothers declared bankruptcy.)

The volume of transactions in the shadow banking system grew dramatically after the year 2000. Its growth was checked by the 2008 crisis and for a short while it declined in size, both in the US and in the rest of the world.[6][7] In 2007 the Financial Stability Board estimated the size of the SBS in the U.S. to be around $25 trillion, but by 2011 estimates indicated a decrease to $24 trillion.[8] Globally, a study of the 11 largest national shadow banking systems found that they totaled to $50 trillion in 2007, fell to $47 trillion in 2008 but by late 2011 had climbed to $51 trillion, just over its estimated size before the crisis. Overall, the world wide SBS totalled to about $60 trillion as of late 2011.[6] In November 2012 Bloomberg reported on a Financial Stability Board report showing an increase of the SBS to about $67 trillion.[9] It is unclear to what extent various measures of the shadow banking system include activities of regulated banks, such as bank borrowing in the repo market and the issuance of bank-sponsored asset-backed commercial paper. Banks by far are the largest issuers of commercial paper in the United States, for example.

As of 2013, academic research has suggested that the true size of the shadow banking system may have been over $100 trillion as of 2012.[10]

Shadow banking institutions are typically intermediaries between investors and borrowers. For example, an institutional investor like a pension fund may be willing to lend money, while a corporation may be searching for funds to borrow. The shadow banking institution will channel funds from the investor(s) to the corporation, profiting either from fees or from the difference in interest rates between what it pays the investor(s) and what it receives from the borrower.

Hervé Hannoun, Deputy General Manager of the Bank for International Settlements(BIS) described the structure of this shadow banking system to at the annual South East Asian Central Banks (SEACEN) conference.(Hannoun 2008)[2]

This sector was worth an estimated $60 trillion in 2010, compared to prior FSB estimates of $27 trillion in 2002.[12][8] While the sector's assets declined during the global financial crisis, they have since returned to their pre-crisis peak[13] except in the United States where they have declined substantially.

A 2013 paper by Fiaschi et. al. used a statistical analysis based the deviation from the Zipf distribution of the sizes of the world's largest financial entities to infer that that the size of the shadow banking system may have been over $100 trillion in 2012.[10][14]

There are concerns that more business may move into the shadow banking system as regulators seek to bolster the financial system by making bank rules stricter.[13]

Shadow banks can also cause a buildup of systemic risk indirectly because they are interrelated with the traditional banking system via credit intermediation chains, meaning that problems in this unregulated system can easily spread to the traditional banking system. As shadow banks use a lot of short-term deposit-like funding but do not have deposit insurance like mainstream banks, a loss of confidence can lead to "runs" on these unregulated institutions.[20] Shadow banks' collateralised funding is also considered a risk because it can lead to high levels of financial leverage. By transforming the maturity of credit—such as from long-term to short term—shadow banks fueled real estate bubbles in the mid-2000s that helped cause the global financial crisis when they burst.

Leverage is considered to be a key risk feature of shadow banks, as well as traditional banks. Leverage is the means by which shadow banks and traditional banks multiply and spread risk. Money market funds are completely unleveraged and thus do not have this risk characteristic.

When Mark Carney was appointed chairman of the FSB in November, he said the global watchdog might introduce direct regulation of the shadow banking system to tackle the risks moving into this unregulated sector from the heavily supervised mainstream banking sector. According to Carney, regulating the shadow banking industry would be a top priority for the FSB, which was likely to implement hard rules for activities like securitisation and money market funds, and use registration requirements to ensure more transparency in others.

The recommendations for G20 leaders on regulating shadow banks were due to be finalised by the end of 2012. The United States and the European Union are already considering rules to increase regulation of areas like securitisation and money market funds, although the need for money market fund reforms has been questioned in the United States in light of reforms adopted by the Securities and Exchange Commission in 2010. The International Monetary Fund suggested that the two policy priorities should be to reduce spillovers from the shadow banking system to the main banking system and to reduce procyclicality and systemic risk within the shadow banking system itself.[18]

The G20 leaders meeting in Russia in September 2013, will endorse the new Financial Stability Board (FSB) global regulations for the shadow banking systems which will come into effect by 2015.(Jones 2013)[1]

In a June 2008 speech, Timothy Geithner, then President and CEO of the Federal Reserve Bank of New York, described the growing importance of what he called the "non-bank financial system": "In early 2007, asset-backed commercial paper conduits, in structured investment vehicles, in auction-rate preferred securities, tender option bonds and variable rate demand notes, had a combined asset size of roughly $2.2 trillion. Assets financed overnight in triparty repo grew to $2.5 trillion. Assets held in hedge funds grew to roughly $1.8 trillion. The combined balance sheets of the then five major investment banks totaled $4 trillion. In comparison, the total assets of the top five bank holding companies in the United States at that point were just over $6 trillion, and total assets of the entire banking system were about $10 trillion."[22]

CONTRIBUTION TO THE 2007–2012 FINANCIAL CRISIS

Economist Paul Krugman described the run on the shadow banking system as the "core of what happened" to cause the crisis. "As the shadow banking system expanded to rival or even surpass conventional banking in importance, politicians and government officials should have realized that they were re-creating the kind of financial vulnerability that made the Great Depression possible—and they should have responded by extending regulations and the financial safety net to cover these new institutions. Influential figures should have proclaimed a simple rule: anything that does what a bank does, anything that has to be rescued in crises the way banks are, should be regulated like a bank." He referred to this lack of controls as "malign neglect."[42]

One former banking regulator has said that regulated banking organizations are the largest shadow banks and that shadow banking activities within the regulated banking system were responsible for the severity of the financial crisis[4][43]

The core activities of investment banks are subject to regulation and monitoring by central banks and other government institutions - but it has been common practice for investment banks to conduct many of their transactions in ways that don't show up on their conventional balance sheet accounting and so are not visible to regulators or unsophisticated investors.[5] For example, prior to the 2007-2012 financial crisis, investment banks financed mortgages through off-balance sheet (OBS), or Incognito Leverage, securitizations (e.g. asset-backed commercial paper programs) and hedged risk through off-balance sheet credit default swaps.[5] No major investment banks exist in the United States other than those that are part of the regulated banking system. (In 2008, Morgan Stanley and Goldman Sachs became bank holding companies, Merrill Lynch and Bear Stearns were acquired by bank holding companies, and Lehman Brothers declared bankruptcy.)

The volume of transactions in the shadow banking system grew dramatically after the year 2000. Its growth was checked by the 2008 crisis and for a short while it declined in size, both in the US and in the rest of the world.[6][7] In 2007 the Financial Stability Board estimated the size of the SBS in the U.S. to be around $25 trillion, but by 2011 estimates indicated a decrease to $24 trillion.[8] Globally, a study of the 11 largest national shadow banking systems found that they totaled to $50 trillion in 2007, fell to $47 trillion in 2008 but by late 2011 had climbed to $51 trillion, just over its estimated size before the crisis. Overall, the world wide SBS totalled to about $60 trillion as of late 2011.[6] In November 2012 Bloomberg reported on a Financial Stability Board report showing an increase of the SBS to about $67 trillion.[9] It is unclear to what extent various measures of the shadow banking system include activities of regulated banks, such as bank borrowing in the repo market and the issuance of bank-sponsored asset-backed commercial paper. Banks by far are the largest issuers of commercial paper in the United States, for example.

As of 2013, academic research has suggested that the true size of the shadow banking system may have been over $100 trillion as of 2012.[10]

1 ENTITIES THAT MAKE UP THE SYSTEM

Shadow institutions typically do not have banking licenses and don't take deposits like a depository bank and therefore are not subject to the same regulations. Complex legal entities comprising the system include hedge funds, structured investment vehicles (SIV), special purpose entity conduits (SPE), money market funds, repurchase agreement (repo) markets and other non-bank financial institutions.[11] Many shadow banking entities are sponsored by banks or are affiliated with banks through their subsidiaries or parent bank holding companies. The inclusion of money market funds in the definition of shadow banking has been questioned in view of their relatively simple structure and the highly regulated and unleveraged nature of these entities, which are considered safer, more liquid, and more transparent than banks.Shadow banking institutions are typically intermediaries between investors and borrowers. For example, an institutional investor like a pension fund may be willing to lend money, while a corporation may be searching for funds to borrow. The shadow banking institution will channel funds from the investor(s) to the corporation, profiting either from fees or from the difference in interest rates between what it pays the investor(s) and what it receives from the borrower.

Hervé Hannoun, Deputy General Manager of the Bank for International Settlements(BIS) described the structure of this shadow banking system to at the annual South East Asian Central Banks (SEACEN) conference.(Hannoun 2008)[2]

"With the development of the originate-to-distribute model, banks and other lenders are able to extend loans to borrowers and then to package those loans into ABSs, CDOs, asset-backed commercial paper (ABCP) and structured investment vehicles (SIVs). These packaged securities are then sliced into various tranches, with the highly rated tranches going to the more risk-averse investors and the subordinate tranches going to the more adventurous investors."The shadow banking system makes up 25 to 30 percent of the total financial system, according to the Financial Stability Board (FSB), a regulatory task force for the world's group of top 20 economies (G20).

—Hannoun, 2008

This sector was worth an estimated $60 trillion in 2010, compared to prior FSB estimates of $27 trillion in 2002.[12][8] While the sector's assets declined during the global financial crisis, they have since returned to their pre-crisis peak[13] except in the United States where they have declined substantially.

A 2013 paper by Fiaschi et. al. used a statistical analysis based the deviation from the Zipf distribution of the sizes of the world's largest financial entities to infer that that the size of the shadow banking system may have been over $100 trillion in 2012.[10][14]

There are concerns that more business may move into the shadow banking system as regulators seek to bolster the financial system by making bank rules stricter.[13]

1.1 SHADOW BANKS ROLE AND THEIR MODUS OPERANDI

Like regular banks, shadow banks provide credit and generally increase the liquidity of the financial sector. Yet unlike their more regulated competitors, they lack access to central bank funding or safety nets such as deposit insurance and debt guarantees.(2009 Hall)[13][15] In contrast to traditional banks, shadow banks do not take deposits. Instead, they rely on short-term funding provided either by asset-backed commercial paper or by the repo market, in which borrowers in substance offer collateral as security against a cash loan, through the mechanism of selling the security to a lender and agreeing to repurchase it at an agreed time in the future for an agreed price.[13] Money market funds do not rely on short-term funding; rather, they are investment pools that provide short-term funding by investing in short-term debt instruments issued by banks, corporations, state and local governments, and other borrowers. The shadow banking sector operates across the American, European, and Chinese financial sectors,[16](Boesler 2012)[17] and in perceived tax havens worldwide.[13] Shadow banks can be involved in the provision of long-term loans like mortgages, facilitating credit across the financial system by matching investors and borrowers individually or by becoming part of a chain involving numerous entities, some of which may be mainstream banks.[13] Due in part to their specialized structure, shadow banks can sometimes provide credit more cost-efficiently than traditional banks.[13] A headline study by the International Monetary Fund defines the two key functions of the shadow banking system as securitization – to create safe assets, and collateral intermediation – to help reduce counterparty risks and facilitate secured transactions.[18] In the US, prior to the 2008 financial crisis, the shadow banking system had overtaken the regular banking system in supplying loans to various types of borrower; including businesses, home and car buyers, students and credit users.[19] As they are often less risk averse than regular banks, entities from the shadow banking system will sometimes provide loans to borrowers who might otherwise be refused credit.[13] Money market funds are considered more risk averse than regular banks and thus lack this risk characteristic.1.2 RISKS ASSOCIATED WITH SHADOW BANKING

As shadow banks do not take deposits, they are subject to less regulation than traditional banks. They can therefore increase the rewards they get from investments by leveraging up much more than their mainstream counterparts and this can lead to risks mounting in the financial system. Unregulated shadow institutions can be used to circumvent the strictly regulated mainstream banking system and therefore avoid rules designed to prevent financial crises. Money market funds are highly regulated under the Investment Company Act of 1940, which imposes stricter regulation than banking regulation.Shadow banks can also cause a buildup of systemic risk indirectly because they are interrelated with the traditional banking system via credit intermediation chains, meaning that problems in this unregulated system can easily spread to the traditional banking system. As shadow banks use a lot of short-term deposit-like funding but do not have deposit insurance like mainstream banks, a loss of confidence can lead to "runs" on these unregulated institutions.[20] Shadow banks' collateralised funding is also considered a risk because it can lead to high levels of financial leverage. By transforming the maturity of credit—such as from long-term to short term—shadow banks fueled real estate bubbles in the mid-2000s that helped cause the global financial crisis when they burst.

Leverage is considered to be a key risk feature of shadow banks, as well as traditional banks. Leverage is the means by which shadow banks and traditional banks multiply and spread risk. Money market funds are completely unleveraged and thus do not have this risk characteristic.

1.3 Recent attempts to regulate the shadow banking system

In the United States the Dodd-Frank Act, passed in 2010, made provisions which go some way towards regulating the shadow banking system by stipulating that the Federal Reserve System would have the power to regulate all institutions of systemic importance, for example. Other provisions include registration requirements for advisers of hedge funds which have assets totalling more than $150 million and a requirement for the bulk of over-the-counter derivatives trades to go through exchanges and clearing houses.When Mark Carney was appointed chairman of the FSB in November, he said the global watchdog might introduce direct regulation of the shadow banking system to tackle the risks moving into this unregulated sector from the heavily supervised mainstream banking sector. According to Carney, regulating the shadow banking industry would be a top priority for the FSB, which was likely to implement hard rules for activities like securitisation and money market funds, and use registration requirements to ensure more transparency in others.

The recommendations for G20 leaders on regulating shadow banks were due to be finalised by the end of 2012. The United States and the European Union are already considering rules to increase regulation of areas like securitisation and money market funds, although the need for money market fund reforms has been questioned in the United States in light of reforms adopted by the Securities and Exchange Commission in 2010. The International Monetary Fund suggested that the two policy priorities should be to reduce spillovers from the shadow banking system to the main banking system and to reduce procyclicality and systemic risk within the shadow banking system itself.[18]

The G20 leaders meeting in Russia in September 2013, will endorse the new Financial Stability Board (FSB) global regulations for the shadow banking systems which will come into effect by 2015.(Jones 2013)[1]

2 Importance

Many "shadow bank"-like institutions and vehicles have emerged in American and European markets, between the years 2000 and 2008, and have come to play an important role in providing credit across the global financial system.[5][21]In a June 2008 speech, Timothy Geithner, then President and CEO of the Federal Reserve Bank of New York, described the growing importance of what he called the "non-bank financial system": "In early 2007, asset-backed commercial paper conduits, in structured investment vehicles, in auction-rate preferred securities, tender option bonds and variable rate demand notes, had a combined asset size of roughly $2.2 trillion. Assets financed overnight in triparty repo grew to $2.5 trillion. Assets held in hedge funds grew to roughly $1.8 trillion. The combined balance sheets of the then five major investment banks totaled $4 trillion. In comparison, the total assets of the top five bank holding companies in the United States at that point were just over $6 trillion, and total assets of the entire banking system were about $10 trillion."[22]

CONTRIBUTION TO THE 2007–2012 FINANCIAL CRISIS

Main article: Great Recession

The shadow banking system has been implicated as significantly contributing to the global financial crisis of 2007–2012.[5][39][40][41]

In a June 2008 speech, U.S. Treasury Secretary Timothy Geithner, then

President and CEO of the New York Federal Reserve Bank, placed

significant blame for the freezing of credit markets on a "run" on the

entities in the shadow banking system by their counterparties. The rapid

increase of the dependency of bank and non-bank financial institutions

on the use of these off-balance sheet entities to fund investment

strategies had made them critical to the credit markets underpinning the

financial system as a whole, despite their existence in the shadows,

outside of the regulatory controls governing commercial banking

activity. Furthermore, these entities were vulnerable because they

borrowed short-term in liquid markets to purchase long-term, illiquid

and risky assets. This meant that disruptions in credit markets would

make them subject to rapid deleveraging, selling their long-term assets

at depressed prices.[22]Economist Paul Krugman described the run on the shadow banking system as the "core of what happened" to cause the crisis. "As the shadow banking system expanded to rival or even surpass conventional banking in importance, politicians and government officials should have realized that they were re-creating the kind of financial vulnerability that made the Great Depression possible—and they should have responded by extending regulations and the financial safety net to cover these new institutions. Influential figures should have proclaimed a simple rule: anything that does what a bank does, anything that has to be rescued in crises the way banks are, should be regulated like a bank." He referred to this lack of controls as "malign neglect."[42]

One former banking regulator has said that regulated banking organizations are the largest shadow banks and that shadow banking activities within the regulated banking system were responsible for the severity of the financial crisis[4][43]

- This page was last modified on October 24, 2013 at 22:42.

- Text is available under the Creative Commons Attribution-ShareAlike License;

additional terms may apply. By using this site, you agree to the Terms of Use and Privacy Policy.

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization.

news, opinion, currencies, markets,

deficit,

ecb,

fed,

federal reserve,

gdp,

hedge funds,

imf,

shadow banking

Location: Chicago, IL, USA

Chicago, IL, USA

Friday, December 7, 2012

The Fat and Skinny on Fiscal Cliff Facts - A Must-Read

Dueling Fiscal Cliff Deceptions

This article is from the balanced watch group, FactCheck.org. It is more than worthwhile to absorb this information in order to sift through what is rhetoric and what is fact. Whether one is a Democrat, Republican, Libertarian or other, there is no need to be ignorant on issues and simply parrot what is heard but not qualified.

This article is from the balanced watch group, FactCheck.org. It is more than worthwhile to absorb this information in order to sift through what is rhetoric and what is fact. Whether one is a Democrat, Republican, Libertarian or other, there is no need to be ignorant on issues and simply parrot what is heard but not qualified.

news, opinion, currencies, markets,

austerity,

bible prophecy,

deficit,

democrats,

end times,

Faith,

fiscal cliff,

geithner,

God,

medicaid,

medicare,

obama,

president,

republicans,

white house

Thursday, December 6, 2012

Is The Petro Dollar On The Way Out?

Is the Age of the PetroDollar Over?

In 2003, the three of the Open Nations started using the Euro and Yuan in their international oil trading. It signaled the first time that the 'almighty' dollar' was no longer the desired reserve currency - a shift, though subtle, had / has far-reaching implications concerning the global confidence in our currency and Nation.

In 2003, the three of the Open Nations started using the Euro and Yuan in their international oil trading. It signaled the first time that the 'almighty' dollar' was no longer the desired reserve currency - a shift, though subtle, had / has far-reaching implications concerning the global confidence in our currency and Nation.

Sunday, November 11, 2012

The President Racks Up The 4 Largest Deficits In Modern History

news, opinion, currencies, markets,

deficit,

economy,

end times,

fed,

federal reserve,

freddie steel,

interest,

life church,

obama,

prophecy,

recession

Subscribe to:

Posts (Atom)