World's First Bitcoin ATM Set to Go Live Tuesday | Wired Enterprise | Wired.com

Bitcoins are cryptocurrency for conducting global trade through peer-to-peer merchants. - Freddie Steel

Bitcoin (sign:  ; code: BTC or XBT[8]) is a distributed peer-to-peer digital currency that functions without the intermediation of any central authority.[9] The concept was introduced in a 2008 paper by a pseudonymous developer known only as "Satoshi Nakamoto".[1]

; code: BTC or XBT[8]) is a distributed peer-to-peer digital currency that functions without the intermediation of any central authority.[9] The concept was introduced in a 2008 paper by a pseudonymous developer known only as "Satoshi Nakamoto".[1]

Bitcoin is called a cryptocurrency since it is decentralized and uses cryptography to prevent double-spending, a significant challenge inherent to digital currencies.[9] Once validated, every individual transaction is permanently recorded in a public ledger known as the blockchain.[9] The calculations required to authenticate Bitcoin transactions are completed using a network of private computers often specially tailored to this task.[10] As of May 2013, the Bitcoin network processing power "exceeds the combined processing strength of the top 500 most powerful supercomputers".[11] The operators of these computers, known as "miners", are rewarded with transaction fees and newly minted bitcoins. However, new bitcoins are created at an ever-decreasing rate.[9] Once 21 million bitcoins are distributed, issuance will cease.[9] As of August 2013, approximately 11.5 million bitcoins were in circulation.[12]

In 2012, The Economist reasoned that Bitcoin has been popular due to "its role in dodgy online markets,"[13] and in 2013 the FBI shut down one such service, Silk Road, which allowed the sale of illegal drugs for bitcoins. However, bitcoins are increasingly used as payment for legitimate products and services.[14] Notable vendors include Wordpress, OkCupid, Reddit, and Chinese Internet giant Baidu.[15]

Speculators have been attracted to Bitcoin, fueling volatility and price swings. In July 2013, Cameron and Tyler Winklevoss asserted that "there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators."[16]

The Bitcoin network protocol operates to provide solutions to the problems associated with creating a decentralized currency and a peer-to-peer payment network. Key among them is the use of a blockchain to achieve consensus and to solve the double-spending problem.

A bitcoin is defined by a chain of digitally-signed transactions that began with its creation as a block reward through bitcoin mining. Each owner transfers bitcoins to the next by digitally signing them over to the next owner in a Bitcoin transaction. A payee can then verify each previous transaction to verify the chain of ownership.

Bitcoin exchanges regularly fail, and the vast majority of transactions are completed on a single exchange that was originally a site for trading Magic: The Gathering cards online, Mt. Gox.

According to Reuters, undisclosed documents indicate that banks such as Morgan Stanley and Goldman Sachs have visited Bitcoin exchanges as often as 30 times a day. Employees of international banks and major financial organizations have shown interest in Bitcoin markets as well.[100]

Bitcoins have been described as lacking intrinsic value as an investment because their value depends only on the willingness of users to accept it.[106][107][108] In addition, a study indicated that 45 percent of Bitcoin exchanges end up closing with many customers losing their money.[109]

Like many assets, bitcoins are also subject to theft.

Derivatives on bitcoins are thinly available. One organization offers futures contracts on bitcoins against multiple currencies.[110]

Several bitcoin investors have become entrepreneurs in the evolving bitcoin universe. Efforts are underway to build financial services, new exchanges, and new payment products using bitcoin. Interest in the bitcoin sector has arisen from investment funds, with recent Peter Thiel's Founders Fund investing US$3 million in the sector and the Winklevoss twins making a US$1.5 million investment.[111]

Bitcoins are cryptocurrency for conducting global trade through peer-to-peer merchants. - Freddie Steel

Bitcoin

From Wikipedia, the free encyclopedia

| Bitcoin | |

|---|---|

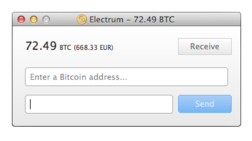

A digital Bitcoin wallet

|

|

| Ledger | The majority of the Bitcoin peer-to-peer network regulates transactions and balances.[1][2] |

| Date of introduction | 3 January 2009 |

| Source | Bitcoin Genesis Block |

| User(s) | International |

| Issuance | Limited release |

| Source | Total BTC in Circulation |

| Method | The rate of new bitcoin creation will be halved every four years until there are 21 million BTC[3] |

| Subunit | |

| .001 | mBTC (millicoin) |

| .000001 | μBTC (microcoin) |

| .00000001 | satoshi[4] |

| Symbol | BTC, XBT,[5] |

Bitcoin is called a cryptocurrency since it is decentralized and uses cryptography to prevent double-spending, a significant challenge inherent to digital currencies.[9] Once validated, every individual transaction is permanently recorded in a public ledger known as the blockchain.[9] The calculations required to authenticate Bitcoin transactions are completed using a network of private computers often specially tailored to this task.[10] As of May 2013, the Bitcoin network processing power "exceeds the combined processing strength of the top 500 most powerful supercomputers".[11] The operators of these computers, known as "miners", are rewarded with transaction fees and newly minted bitcoins. However, new bitcoins are created at an ever-decreasing rate.[9] Once 21 million bitcoins are distributed, issuance will cease.[9] As of August 2013, approximately 11.5 million bitcoins were in circulation.[12]

In 2012, The Economist reasoned that Bitcoin has been popular due to "its role in dodgy online markets,"[13] and in 2013 the FBI shut down one such service, Silk Road, which allowed the sale of illegal drugs for bitcoins. However, bitcoins are increasingly used as payment for legitimate products and services.[14] Notable vendors include Wordpress, OkCupid, Reddit, and Chinese Internet giant Baidu.[15]

Speculators have been attracted to Bitcoin, fueling volatility and price swings. In July 2013, Cameron and Tyler Winklevoss asserted that "there is relatively small use of bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators."[16]

1.2 Payment network and mining

The Bitcoin network protocol operates to provide solutions to the problems associated with creating a decentralized currency and a peer-to-peer payment network. Key among them is the use of a blockchain to achieve consensus and to solve the double-spending problem.

A bitcoin is defined by a chain of digitally-signed transactions that began with its creation as a block reward through bitcoin mining. Each owner transfers bitcoins to the next by digitally signing them over to the next owner in a Bitcoin transaction. A payee can then verify each previous transaction to verify the chain of ownership.

3 Economics

Large fluctuations in the value of Bitcoin have led to criticism of its usefulness as a currency.[93] In addition, its deflationary bias encourages hoarding.[94] This reduces the the use value of a currency and has been the downfall of other private currencies.[95] However, currently Bitcoin does see some use as a currency[96] as well as being saved by individuals.[97]3.1 Exchanges

Through various exchanges, bitcoins are bought and sold at a variable price against the value of other currency. Bitcoin has appreciated rapidly in relation to other currencies including the US dollar, euro and British pound.[84][98][99]Bitcoin exchanges regularly fail, and the vast majority of transactions are completed on a single exchange that was originally a site for trading Magic: The Gathering cards online, Mt. Gox.

According to Reuters, undisclosed documents indicate that banks such as Morgan Stanley and Goldman Sachs have visited Bitcoin exchanges as often as 30 times a day. Employees of international banks and major financial organizations have shown interest in Bitcoin markets as well.[100]

3.2 Bitcoin as an investment

Although the Bitcoin Project describes bitcoin exclusively as an "experimental digital currency," [101] bitcoins are often traded as an investment.[102] Critics have accused bitcoin of being a form of investment fraud known as a Ponzi scheme.[103][104] A case study report[105] by the European Central Bank observes that the bitcoin currency system shares some characteristics with Ponzi schemes, but also has characteristics which are distinct from the common aspects of Ponzi schemes as defined by the U.S. Securities and Exchange Commission.Bitcoins have been described as lacking intrinsic value as an investment because their value depends only on the willingness of users to accept it.[106][107][108] In addition, a study indicated that 45 percent of Bitcoin exchanges end up closing with many customers losing their money.[109]

Like many assets, bitcoins are also subject to theft.

Derivatives on bitcoins are thinly available. One organization offers futures contracts on bitcoins against multiple currencies.[110]

Several bitcoin investors have become entrepreneurs in the evolving bitcoin universe. Efforts are underway to build financial services, new exchanges, and new payment products using bitcoin. Interest in the bitcoin sector has arisen from investment funds, with recent Peter Thiel's Founders Fund investing US$3 million in the sector and the Winklevoss twins making a US$1.5 million investment.[111]

Hey Thanks for sharing this blog its very helpful to implement in our work

ReplyDeleteRegards

Bitcoin Account Recovery